The SBI Public Provident Fund (PPF) scheme is a secure and profitable investment plan backed by the Government of India. It allows investors to grow their savings over time while enjoying tax benefits. A minimum investment of Rs 500 per month can accumulate into a significant amount over a tenure of 15 years. With an annual interest rate of 7.1%, the scheme is a favorable option for individuals seeking financial stability and long-term growth.

Overview of SBI Public Provident Fund Scheme

| Feature | Details |

|---|---|

| Managing Authority | State Bank of India |

| Scheme Name | Public Provident Fund (PPF) |

| Investment Type | Secure, Long-Term Savings |

| Minimum Deposit | Rs 500 Monthly |

| Maximum Annual Limit | Rs 1,50,000 |

| Tenure | 15 Years (Extendable in 5-Year Blocks) |

| Interest Rate | 7.1% (Revised Quarterly) |

| Official Website | www.sbi.co.in |

Noteworthy Features of SBI PPF Scheme

Investment Limits & Duration

Investors can deposit a minimum of Rs 500 monthly or up to Rs 1,50,000 per annum. The original tenure is 15 years, with an option to extend in 5-year intervals. The scheme encourages disciplined savings by offering flexibility in deposit frequency—either as a lump sum or in multiple installments.

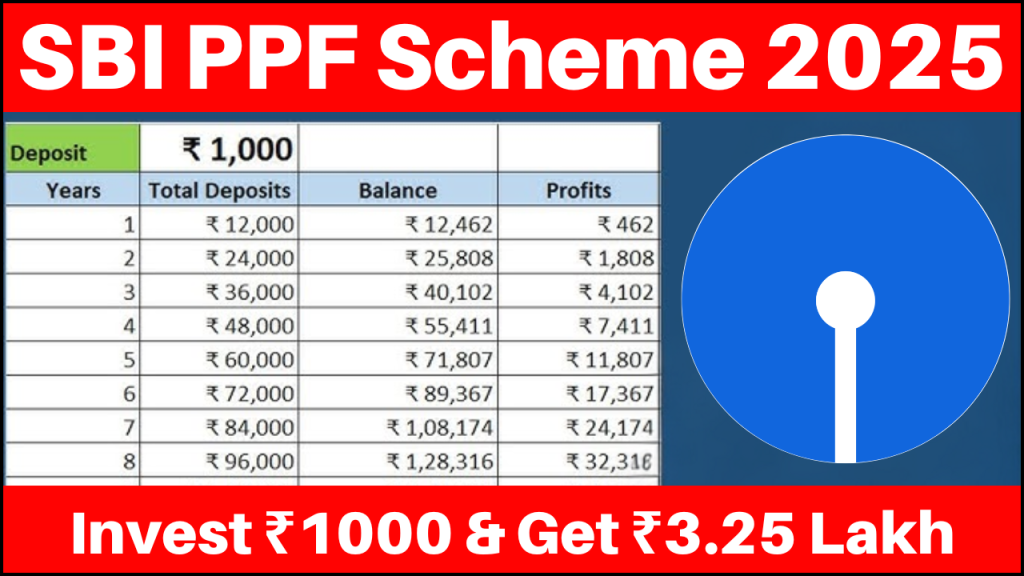

Interest Rate & Growth Potential

The interest rate, regulated by the central government, is reviewed every quarter. As of now, the rate stands at 7.1% annually. The interest is compounded annually, providing a steady and reliable return over time.

Tax Benefits & Nomination Facility

Under Section 80C of the Income Tax Act, contributions to the PPF account are eligible for tax deductions. Additionally, both interest earned and the maturity amount are tax-free. Account holders can also nominate one or more beneficiaries, ensuring smooth succession planning.

Loan & Withdrawal Flexibility

Investors can avail of a loan against their PPF balance from the third financial year onwards, with a maximum limit of 25% of the preceding year’s balance. Partial withdrawals are allowed after the sixth year, subject to the available balance and applicable terms.

Regulations & Conditions for SBI PPF Account

Deposit Structure & Interest Calculation

Deposits can be made in a lump sum or monthly, ensuring flexibility for investors. However, deposits exceeding Rs 1,50,000 per annum do not earn interest and are ineligible for tax deductions. Interest calculation is based on the minimum balance maintained between the 5th and the last day of each month.

Premature Closure & Withdrawals

Though the PPF account matures in 15 years, premature closure is permitted under specific circumstances, such as:

- Critical illness of the account holder or their dependents.

- Higher education expenses of the account holder or their children.

- Change in residency status.

Withdrawals are permitted from the 7th year onwards, but only a percentage of the balance can be accessed.

Step-by-Step Guide to Opening an SBI PPF Account

Opening a PPF account with SBI is simple and can be done online or at a bank branch. The following steps must be followed:

- Eligibility Check: Any Indian citizen can open an account, and parents can also initiate one for their minor children.

- Required Documents: Aadhaar card, PAN card, address proof, and passport-size photographs.

- Online Process:

- Visit the SBI official website.

- Select the “PPF Account” option.

- Complete the form and upload necessary documents.

- Submit the application for processing.

- Offline Process:

- Visit the nearest SBI branch.

- Fill out the PPF application form.

- Submit KYC documents and an initial deposit.

- Collect account details and passbook upon approval.

Advantages of SBI PPF Scheme

- Risk-Free Investment: Being a government-backed scheme, it ensures security.

- High Returns: The interest rate is competitive compared to fixed deposits and other savings plans.

- Tax Savings: The scheme offers EEE (Exempt-Exempt-Exempt) tax benefits.

- Flexible Contributions: Investors can contribute monthly or yearly as per their financial capacity.

- Loan & Withdrawal Benefits: Easy access to funds through loans and partial withdrawals.

Frequently Asked Questions (FAQs)

1. Can NRIs open an SBI PPF account?

Ans: No, Non-Resident Indians (NRIs) are not allowed to open new PPF accounts. However, if an individual had a PPF account before acquiring NRI status, they can continue it until maturity but cannot extend it further.

2. What happens if I fail to deposit the minimum amount in a year?

Ans: If the minimum annual deposit of Rs 500 is not made, the account will be considered inactive. To reactivate it, a penalty of Rs 50 per inactive year must be paid along with the pending minimum deposit.

3. Can I transfer my PPF account from one bank to another?

Ans: Yes, SBI allows the transfer of PPF accounts between its branches, other banks, or post offices upon request, without any additional charges.

Final Thoughts

The SBI PPF Scheme is an ideal savings plan for individuals looking to build a secure financial future. With flexible deposits, tax exemptions, and a reliable interest rate, this scheme is an attractive option for risk-averse investors. It is particularly beneficial for those planning long-term wealth accumulation, children’s education, or retirement savings. Investing in this government-supported plan ensures a stable and promising financial outlook.