The Employees’ Pension Scheme (EPS), managed by the Employees’ Provident Fund Organisation (EPFO), is among India’s most significant social security programs. Launched on November 16, 1995, the scheme ensures a stable post-retirement income for employees in the organized sector. With the announcement of the EPFO pension enhancement in 2025, pensioners can expect a considerable increase in their monthly payments.

Importance of EPFO Pension Enhancement 2025

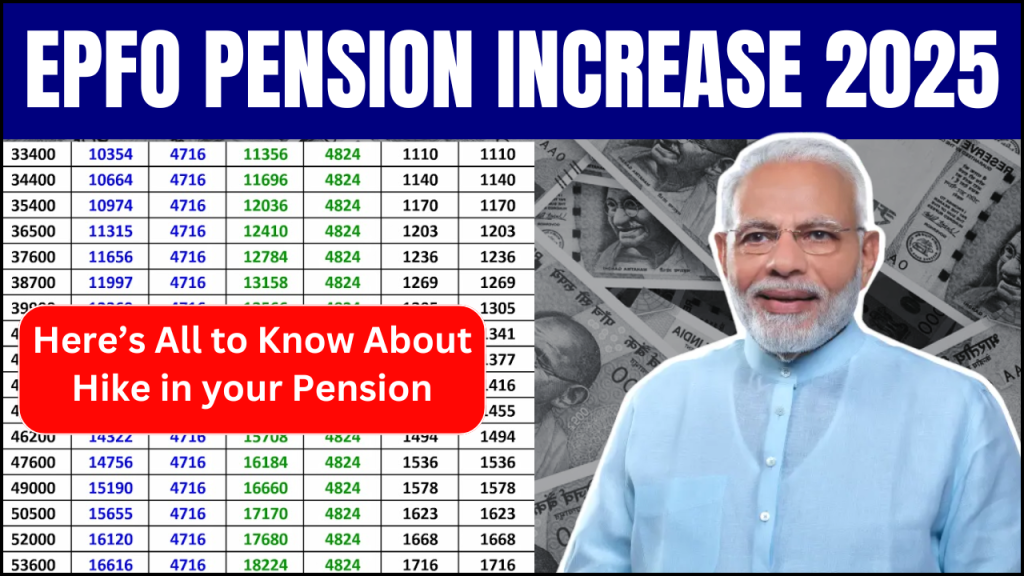

The government has suggested raising the wage ceiling for contributions under the Employees’ Provident Fund (EPF) and EPS-95 from Rs. 15,000 to Rs. 21,000 as part of the Union Budget 2025. This increase will directly impact pension calculations under EPS-95. Currently, the maximum pension under EPS-95 stands at Rs. 7,500 per month, which may rise to Rs. 10,050 under the revised wage structure. Furthermore, the EPS-95 National Agitation Committee (NAC) has urged the government to raise the minimum pension from Rs. 1,000 to Rs. 7,500.

Eligibility for EPFO Pension Enhancement 2025

To benefit from the revised EPS pension, employees must meet certain criteria:

- Service Duration: A minimum of 10 years of continuous service under EPS is mandatory.

- Age Requirement: Pension benefits become accessible at the age of 58.

- Consistent Contributions: Employees must have consistently contributed to EPS throughout their employment tenure.

Employers allocate 12% of employees’ basic salaries to the EPFO-regulated provident fund, with 3.67% directed to the EPF and 8.33% to the EPS. Since 2014, the government has maintained a minimum pension of Rs. 1,000 per month despite persistent appeals for an increase to at least Rs. 7,500.

DA Rates for 2025, Challenges and Recommendations for Future

8th Pay Commission, Expected Benefits and Economic Influence

Impact of EPFO Pension Enhancement on Retirees

Millions of pensioners depending on EPS-95 for financial security will benefit greatly from this revision. The adjustment ensures retirees receive a fair pension amount that meets their growing financial demands.

| Aspect | Current Pension | Revised Pension |

|---|---|---|

| Maximum EPS-95 Pension | Rs. 7,500 | Rs. 10,050 |

| Minimum EPS-95 Pension | Rs. 1,000 | Rs. 7,500 |

| Wage Ceiling for Contributions | Rs. 15,000 | Rs. 21,000 |

This adjustment will enable pensioners to better manage daily expenses amidst rising living costs and healthcare expenditures.

Reasons Behind the Pension Increase

The long-standing demand for a pension revision has been driven by various factors:

- Inflation: The rising costs of goods and services have reduced the purchasing power of pensioners.

- Healthcare Costs: Increased medical expenses necessitate a higher pension amount.

- Rising Cost of Living: Both urban and rural living expenses have surged in recent years.

Recognizing these concerns, the government and EPFO board members decided to modify the pension structure, ensuring financial relief for retired employees.

New EPFO Developments in 2025

EPFO is continuously introducing reforms to enhance operational efficiency and improve user experience. Recent updates include:

- Digital Transformation: Enhanced IT systems to facilitate smoother transactions.

- Centralized Pension Payment System (CPPS): A unified system for timely pension disbursements.

- Streamlined Grievance Redressal: Efforts to reduce processing delays and improve claim settlements.

According to provisional payroll data from November 2024, EPFO recorded a net addition of 14.63 lakh members, marking a 4.88% increase compared to the previous year. This growth reflects a combination of workforce expansion and greater awareness of employee benefits.

Challenges Faced by EPFO Members

Despite positive changes, pensioners have encountered several challenges with EPFO services:

- Delayed Pension Processing: Administrative inefficiencies have led to payment delays.

- Errors in Personal Details: Discrepancies in records often result in rejected claims.

- Limited Awareness of Entitlements: Many pensioners are unaware of the benefits available to them.

To address these issues, EPFO is striving to streamline processes and enhance service delivery through automation.

Frequently Asked Questions (FAQs)

1. How does the EPFO pension enhancement in 2025 benefit pensioners?

Ans: The increase ensures higher monthly payouts, enhancing financial security and quality of life for retirees. The minimum pension is set to rise from Rs. 1,000 to Rs. 7,500.

2. Who qualifies for the EPFO pension increase in 2025?

Ans: Employees who have completed at least 10 years of service, are 58 years or older, and have consistently contributed to EPS are eligible for the revised pension structure.

3. What new changes has EPFO introduced in 2025?

Ans: Apart from the pension hike, EPFO has implemented digital reforms, launched a centralized pension payment system, and improved its grievance redressal mechanisms.

Conclusion

The EPFO pension enhancement in 2025 is a long-awaited reform that offers financial relief to pensioners. By increasing the minimum and maximum pension limits, the government aims to ensure that retirees receive a dignified income post-retirement. With continuous improvements in EPFO operations, pensioners can expect a more efficient and hassle-free experience in accessing their benefits. This move not only supports retirees but also strengthens India’s overall social security framework, reinforcing financial stability for millions of workers in the organized sector.